Investors Hub

Hello All,

I want to re-post a long message I put up on InvestorsHub. I did this in response to questions that were being raised on that message board, as I was alerted to some concerns being raised. I decided to put a “status update” on the board, and now I am including a copy here (since there is a lot of information in the post). I will follow this up with some status updates for the week.

Here is the post, copied and pasted (I added some links):

Hi Everyone, I’m David Sastry, the new CIO of Freedom Motors.

I know there is a lot of discussion here about Moller International, and the new Freedom Motors plans to raise capital. I have not been on this board in a while, but some folks were concerned about some of the discussion here, about what was factual vs. non-factual information. I’ll write a quick update here on the status of Moller International, and what we are doing with Freedom Motors. Things are changing quite quickly at the moment.

So, first I will talk about MI. Currently there no is activity in R&D at MI, and none of our staff are working on aircraft. MI has been in a holding pattern since running out of capital in 2016. However, we have been approached by four investor groups this year (2018) interested in MI technology, all from APAC region countries. Two of them we have met with, one from China gave us an offer of mixed ownership which was rejected. The second investor is a multi-national company ($250 billion market cap), and they are still working on an offer to present to us. We have two more investment groups coming to visit and we will release more information when we are able.

Freedom Motors is far more interesting, because we are working on funding plans right now to bring a Rotapower biogas/APG gen-set to market, which we believe will have a major impact on the market, because the cost to customers is 1/3 the price of the lowest-cost existing solutions. There is a big push by governments, states and other organizations to reduce methane emissions and methane flaring. California has passed a law (SB1383) that requires a 40% reduction in state methane emissions by 2030 (from 2013 emission levels.) The World Bank is pushing a worldwide reduction in APG (associated petroleum gas) flaring, because of the amount of black carbon and other particulates it puts into the atmosphere. The WB wants to get to ZERO flaring, also by 2030.

There are three options that I know of for commercialization of biogas and APG:

– First is to convert to electricity, which is the FM target market.

– Second is to clean it up and put it into an NG supply. In the US, this second option is usually used to push the gas into the transportation industry, because of the EPA RFS credits, and additionally in California, the ARB LCFS credits, which gives biogas/APG producers additional dollars for their gas sales.

– Third option is to turn it into protein. Like for example, www.feedkind.comThe Rotapower engine is unique in it’s ability to run on biogas and sour APG (sour just means high hydrogen sulfide content). For two stroke engine gen-sets, generally you have to clean the hydrogen sulfide (H2S) and the siloxane from the gas before you can use it. The H2S turns into sulfuric acid when exposed to engine oil, and this damages components. The siloxane turns into silica or silicates when it is combusted in the engine, and the silica and silicates will damage the valves on a two-stroke engine over a short period of time. (In the 1970’s, a lot of engines that were used to generate electricity from landfill biogas were failing because of siloxane, and it took the industry a while to figure it out.) If you use a micro-turbine or turbine engine to burn the gas, you don’t have to filter out the H2S, but you still have to filter out the siloxane. For the Rotapower engine, we don’t have to filter out either contaminant. This makes for significant cost savings and reduction in operational & maintenance costs as well. Also, because our combustion is lean and cooler than piston engines, we have very low NOx emissions, which is the biggest contributor to smog.

We have done a market analysis and developed a business plan that shows an IRR of 1,350% over a 5 year period with an initial investment of $5,000,000, with only 3% market penetration. We believe this makes a compelling business case. Also, because our installed costs ($877/kW) are far lower than existing gen-set solutions ($2500/kW) we can make a compelling economic case to customers. Most agricultural customers buy these systems with limited funds, typically 50% grants and 50% loans taken on by the customer. Lower capital costs means less money required from both the grants and the loans, and a much faster payoff (especially with lower O&M for the Rotapower engine). There have been many investor groups in California investing in these generation systems, because they could negotiate 20-year Power Purchase Agreements with Public Utilities for a guaranteed price when selling the electricity. However, this has become much harder to do now, and typically PPAs only worked for very large biogas producers.

Freedom Motors has been approaching various investment groups, and we continue to do so. However, to make things more expedient and keep things under our control, we have initiated a program to request short term loans from various trusted parties and stockholders in order to raise approximately $500,000. This would allow us to complete all the necessary work on a Tier 1(or 2) Reg A+ private securities offering to raise $10,000,000 in operating capital. I have commitments now for $300,000 in loans, but we only started this program on Monday and it is still early, so we hope to get the rest within a week or two. Freedom Motors already has the the SEC paperwork completed (Form 1-A) as we started the filing process in 2016, before it was abandoned. Now we are restarting that process.

There is still a lot of confusion around the PSC deal that was announced at the last Shareholder’s meeting. That deal has not collapsed, but also we can no longer wait for funding. If the funding comes through, great. If not, no big deal because we are moving forward.

The $10,000,000 in operating capital raised by the Reg A+ will be used in two ways. $5,000,000 will be used to setup our low-volume engine manufacturing for the Rotapower 530cc engines for the biogas generator. We have a little engineering work to productize it, including the identifying the control electronics, inverters, induction and/or synchronous PM generators, the fuel system, enclosures, and a few other issues. We expect we can get a prototype built in-situ in about 2-4 months after funding. During this time we will work on marketing and customer relations to “prime” the marketing machine. Our goal is to start making sales of production products within 6-9 months, and we should be profitable within one year.

The second half of the Reg A+ will go into Rotapower engine R&D and some debt reduction. We have applied for a few grants for engine development, so we may get some additional funding through those channels, but we are not planning for it. The R&D is mostly for development work on the smaller engines (27cc) and the compound engine design, which is the key technology for the Skycar. Most of the debt for FM is held unsecured by MI. Some of the debt payback to MI will be used to complete the FAA certification of the Neuera. This will start as soon as funds are available. This could also get funded through some of the investor groups that have visited MI, but again, we are not relying on that, so we are building onto into our Reg A+ plan. We do not have immediate plans to work on the Skycar M400 hybrid prototype, unless we get additional funding. This is partly because this prototype will require the compound engine design which has about 1 year of R&D work to complete. Also, it is because the FAA certification process for the M400 is far more difficult, and any purchaser would have to be a fully licensed pilot. And more importantly, we wouldn’t have as big an immediate market. We have a lot of market interest in the Neuera Firefly for Search & Rescue operations. Also, the agricultural world has been clamoring for a heavy-lift utility drone vehicle, which the Neuera is perfect for (it could be remote controlled, or flown by pilot). The FAA process is much simpler for the Neuera and Neuera Firefly, and operators will not need a full pilot’s license, allowing us to come to the market much faster. Also, we believe a Neuera test flight will bring back some credibility to MI and additional investor interest, as well as renewed stock interest.

That is a summary of our plans – feel free to support them or knock them down, I welcome *all* commentary. I will not get on this board often because I just don’t have the time. I’m hoping that I can hire someone who can deal with the social media outreach in the future, but for right now, there is only me.

If you have any additional questions and you want to reach out to me, feel free to email me at either david@moller.com or david@freedom-motors.com.

Best Regards, Dave

Whew! That was a lot to post………..

Status Update

OK, status update. So by Friday March 2, we are still in the same position with $300,000 committed to us in short-term loans. Terms of these loans has not been released publicly – this loan opportunity was offered to a select few stockholders and longtime investors this week. We are still making calls to get the last $200,000. If anyone is interested in getting involved, please contact me and I can explain the loan terms to you, but only serious lenders are being considered (like, $50,000 loans, not $5,000).

With the $300,000 committed we can now start the Reg A+. Dr. Moller and I are working on reconnecting with StartEngine, our previous launch platform, and the PR firm (Advertising Partners) we were engaged with. This doesn’t mean that we have finalized these decisions – we are still getting professional advice nd looking at all options. Like, Tier 1 vs Tier 2. IPO vs Private. StartEngine vs. ??? If you have suggestions or advice, I would love to hear it.

ICO Update

“Reg A+? What about the ICO?!? I want my EcoX!!!!”

Yes….you probably already realized that we are planning to push off the ICO plan and go a more traditional route. This is partly due to increased regulatory scrutiny on ICOs launched in the US. But also due to the fact that the costs are not much different between a Reg A+* and an ICO, and we would still be stuck with the regulatory requirements of a security offering. We had a difficult time coming up with a model for how a token would fit into our plans, other than as a security. Not that there is no precedent for this – for example this company that is doing an ICO to manufacture compressed gas cylinders.

Because we already have the Reg A+* paperwork mostly complete, except to tweak it for the biogas business model, the Reg A+* seems like the more logical choice. We may come back to the ICO in the future to raise money, but hopefully it will not be necessary.

*NOTICE: NO MONEY OR OTHER CONSIDERATION IS BEING SOLICITED, AND IF SENT IN RESPONSE, WILL NOT BE ACCEPTED. NO OFFER TO BUY THE SECURITIES CAN BE ACCEPTED AND NO PART OF THE PURCHASE PRICE CAN BE RECEIVED UNTIL AN OFFERING STATEMENT TO BE FILED BY THE COMPANY WITH THE SEC HAS BEEN QUALIFIED BY THE SEC. ANY SUCH OFFER MAY BE WITHDRAWN OR REVOKED, WITHOUT OBLIGATION OR COMMITMENT OF ANY KIND, AT ANY TIME BEFORE NOTICE OF ACCEPTANCE GIVEN AFTER THE DATE OF QUALIFICATION. AN INDICATION OF INTEREST INVOLVES NO OBLIGATION OR COMMITMENT OF ANY KIND. NO OFFERING STATEMENT REGARDING THIS OFFERING HAS BEEN FILED WITH THE SEC. WHEN SUCH OFFERING STATEMENT IS FILED, THIS LEGEND WILL BE UPDATED TO IDENTIFY WHERE YOU MAY OBTAIN A COPY OF THE PRELIMINARY OFFERING CIRCULAR THAT IS PART OF SUCH OFFERING STATEMENT.

Valley Air – Pollution Management

So on Thursday I attended a grant funding workshop at Valley Air, aka the San Joaquin Valley Air Pollution Control District (SJVAPCD). This workshop was geared around California bill AB617, which is focused on healthy community air. Most of the grants are centered around removing dirty engines from these communities from cars, trucks, buses, agricultural equipment, etc. Unfortunately there was not a real fit for Freedom Motors in that grant program, but I met some of the District grant managers and I learned about a meeting next week to discuss options on dealing with some of the districts worst pollution issues (including…flaring!) So I will try make that meeting on March 8th and get our name out there.

Biogas Generator Prototype

So we have been discussing a prototype for the biogas generator so we can demonstrate the capabilities of the Rotapower engine. We have a 530cc engine on a dyno, but it obviously cannot generate power. Then we realized: what about the gen-set we already built?

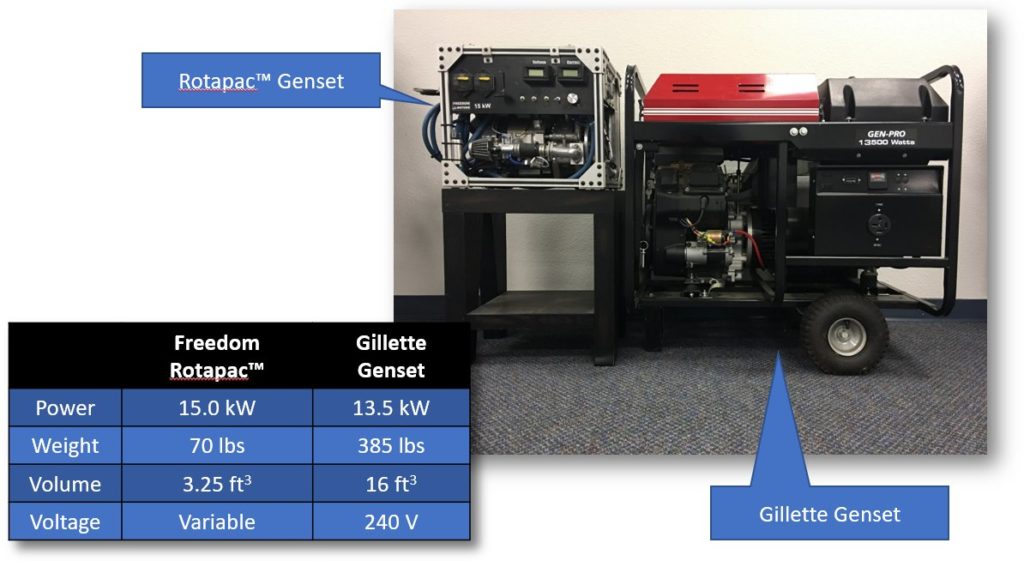

The Rotapac gen-set was built to show the capabilities of the Rotapower engine. In the picture above, the Rotapac 15 kW is compared to a Gillette 13.5 kW unit. From the weight and size you can see an appreciable difference between the systems.

The Rotapac gen-set was built to show the capabilities of the Rotapower engine. In the picture above, the Rotapac 15 kW is compared to a Gillette 13.5 kW unit. From the weight and size you can see an appreciable difference between the systems.

With a small amount of tinkering (new gaseous fuel system w/ turbocharger) we can get this bad boy to run on biogas and demonstrate a working generator. It already has a custom designed synchronous PM generator and a rectifier. We just need to add an 15 kW inverter and a 15 kW load bank for testing we have a working demo system. This will allow us to showcase to potential investors, and do the emissions tests to verify we meet the CA ARB engine certification requirements.

To get the biogas, we are planning on engaging with the Mechanical Engineering Dept at UC Davis, where Dr. Moller is already well known. UC Davis has a anaerobic biodigester on campus which they purchased last year from the operator CleanWorld. Our business plan is focused mostly on the smaller agriculture biogas producers, so this works perfectly for us.

OK, that was a super long blog, but a lot of stuff has happened this week and I wanted to update everyone. Sorry it took so long to get out, but it has been a very busy week. Also, some of you may know that Dr. Moller’s wife Rosa had a bad fall this last week and broke her wrist. She has surgery yesterday at the UC Davis Hospitals in Sacramento to put a support plate in her wrist until the bone heals. Everything went well and she is now resting at home. Wish her a speedy recovery!

Best Regards – Dave