Freedom Motors

Executive Summary from Business Plan

Supporting Regulation A+ stock offering

Freedom Motors

1855 North First St. Suite B

Dixon, CA 95620

+1 (530) 756-1230

www.freedom-motors.com

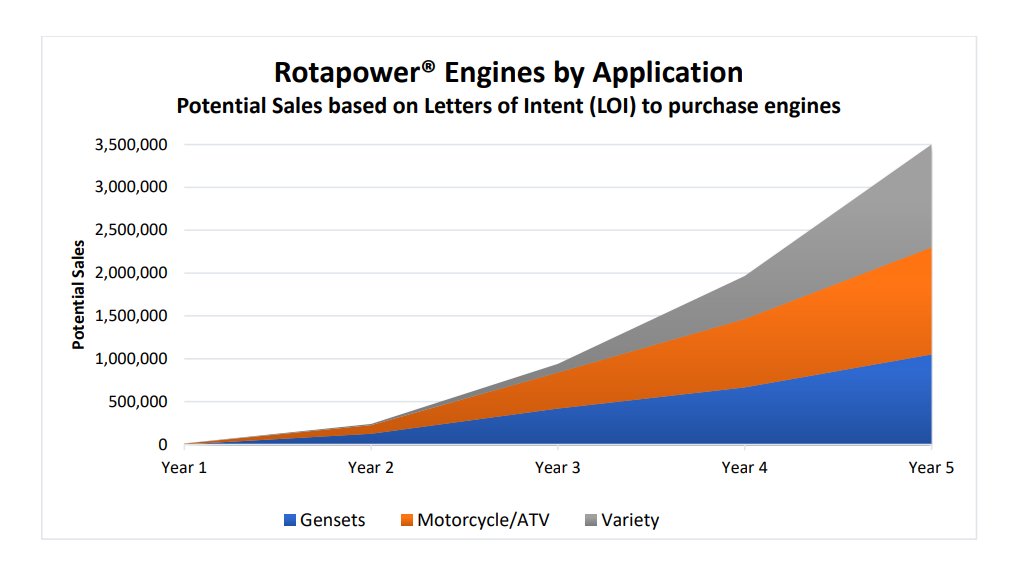

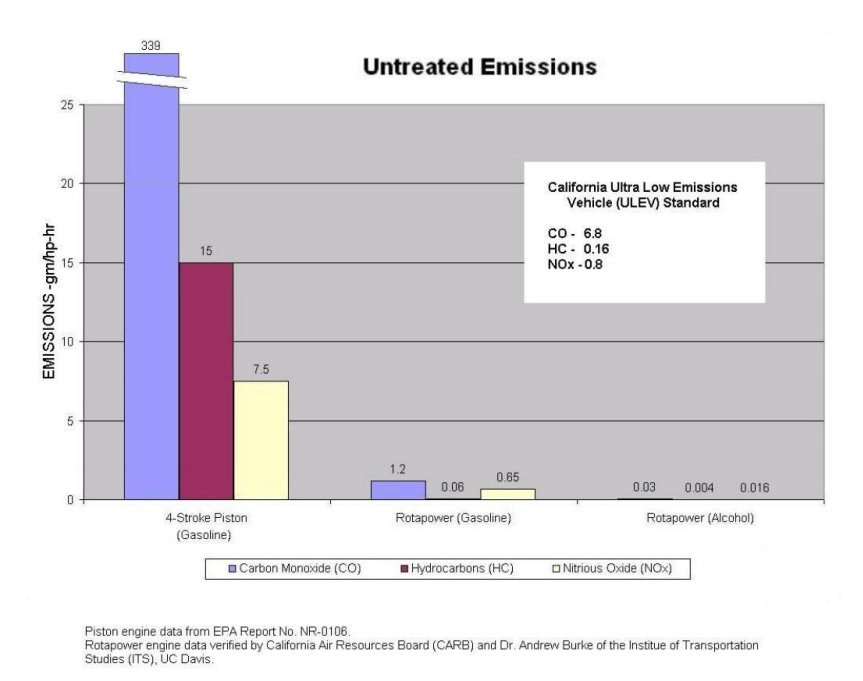

Freedom Motors (the “Company”) has exclusively licensed the worldwide manufacturing and marketing rights to the Rotapower® rotary engine for all applications except aircraft and ducted fans. The Rotapower® engine is based on the Wankel rotary engine design and has a number of unique attributes including extraordinarily high power for its weight and volume, very low emissions, and free of vibration. These characteristics have made it the engine of choice for many applications and resulted in letters of intent (LOI) for nearly 3.5 million engines.

BACKGROUND OF THE ROTAPOWER ROTARY ENGINE

Rotary engines based on the Wankel principle operate with only two moving parts compared to over twenty in a competing 4-stroke piston engine. This lowers cost and greatly improves reliability. The Company was able to acquire the entire rotary engine assets of General Motors (GMC), Infinite Engine Company (IEC) and Outboard Marine Corporation (OMC). GMC had created the machine tools to mass produce rotary engines, while OMC had put a rotary engine into mass production for the recreational market.

Following the acquisition of these rotary engine assets, the Company undertook an extensive engine development program that lengthened the life of the OMC rotary engine design from 500 hours to over 20,000 hours. In the process, the company also:

|

ENGINE PRODUCTION PLANS

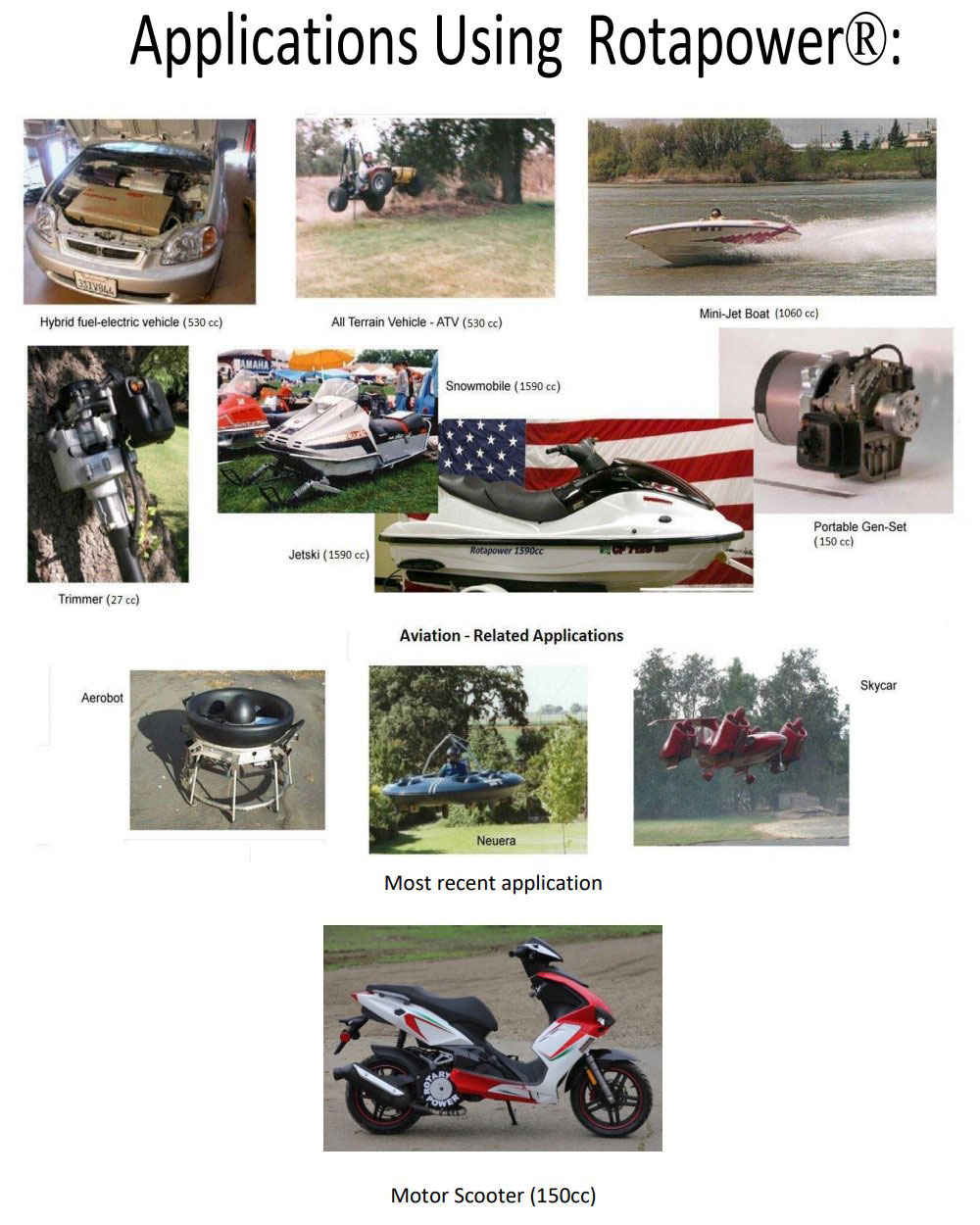

The Company has developed a family of Rotapower® rotary engine utilizing six different rotor displacements. Power output ranges from 2.5 to 450 horsepower. Alpha production engines have been integrated and then demonstrated in a wide variety of applications. The Company will produce engines for its home market of America/Europe, while concurrently sub-licensing engine production for foreign applications were due to logistics and low labor costs it could not compete. Domestic production start-up for its own market and sub-licensee production for the foreign market will require approximately twelve months. During this period the Company will undertake a beta production run of four rotor displacement models and distribute engines to original equipment manufacturers (OEM) who have provided LOIs to purchase engines.

IMMEDIATE MARKET OPPORTUNITY

The market for engines with the unique attributes of the Company’s Rotapower® rotary engine is 165 million engines annually (world market is 250 million engines). The foreign utility motorcycle market alone requires 75 million engines and constitutes a significant portion of the Company’s total letters of intent (LOI) to purchase engines. In addition to its well-established market interest as shown by LOIs from fifteen different countries, new opportunities frequently occur. For example, over 40% of the world’s natural gas is contaminated by CO2 and hydrogen sulfide making it unusable without expensive treatment. The details on why the Rotapower® engine is uniquely able to efficiently use sour gas is shown in Appendix D.

Based on LOIs received and close work with Original Equipment Manufacturers (OEM), the Company believes it should easily exceed the goal of 1% penetration of the America/Europe annual engine production of 25 million engines during year 4 after volume production begins. This would result in the sale of 250,000 engines (0.1% of the world market).

The Company has been funded by a LOI provider from Singapore to integrate and demonstrate the value added when their motorcycle has its piston engine replaced by a Rotapower® engine. The results have shown to be profound with the Rotapower® engine occupying one-third the volume and providing three times the power while completely free from vibration. The Company is negotiating sub-license agreements (two and three wheels) in Singapore/China, Malaysia, and Africa. The Company’s goal for its sub-licensees is to penetrate 5% of the utility motorcycle market four years after volume production begins.

PRODUCTION FUNDING REQUIREMENTS

The pro-forma financials show that the Company plans to raise $10 million in equity funding to reach its production objectives. The Company determined that a Regulation A+ offering of its stock became viable following the recent change in previous Reg A rules allowing unrestricted promotion of stock sales. This eliminated the difficulty of getting an underwriter.

The Company has completed much of the paper work required for a Reg A+ offering including contracting with a well-known advertising agency to promote the stock sale. To complete this offering, up to $500,000 in bridge funding may be needed to help cover operating and promotional expenses.

The Company is proposing to raise this capital through either a convertible secured loan or sale of the Company’s stock, along with warrants. Conversion price of the loan or warrant price will be discounted from the scheduled Reg A+ offering price of $2.50 per share.

RETURN ON INVESTMENT

If the Company meets its five-year financial projections including royalties from sub-license agreements, the compound rate of return (ROI) will be 101% (p/e=15). This assumes the scheduled Reg A+ offering price is $2.50 per share and that the bridge funders are able to acquire stock at a 40% discount from the scheduled offering price.

"SAFE HARBOR" Statement:

This message may contain forward-looking statements. These forward-looking statements are made in reliance on the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Please be advised that the actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the company in forward-looking statements The words "estimate", "possible", “likely” and "seeking", and similar expressions identify forward-looking statements, which speak only as to the date the statement was made. The company undertakes no obligation to publicly update or revise any forwardlooking statements, whether because of new information, future events, or otherwise. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to, the effect of government regulation, competition and other material risks.

Skycar® and Rotapower® are trademarks of Moller International and/or Freedom Motors in the USA and other countries. All other trademarks are the property of their respective owners.